Worship Service

Sunday 9:30 AM

IMPORTANT:

All-Church Picnic date has been changed to

Sunday, July 13th at 11:30am

Nixon Park - Shelter #4

We are a community of Bible-saturated believers driven by a passion for the glory of God in all things.

We are committed to “presenting every believer mature in Christ" (Eph. 4:11-16; Col. 1:28).

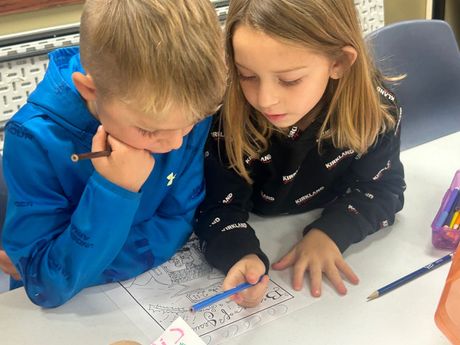

Please join us each Sunday at 9:30 AM for our Worship Service. Nursery is provided for children from newborn to 3 years old. Worship training (children's church) is available during the Worship Service for kids ages 3-7 years old.

Lake Country Bible Church is dedicated to the message of salvation by grace, through faith, in Christ alone.

We are committed to the authority of the Scriptures, to God-honoring worship, to serving the Lord and to evangelism here and abroad.

From the pulpit to Sunday school and youth ministry, biblical exposition is the heart of how we preach and teach the Word of God at Lake Country Bible Church.

Learn more.

Our Location

N45W32481 Watertown Plank Rd

Nashotah, WI 53058

We’d love to answer any questions you might have about the Gospel or our church. Please stop by the Welcome Counter in the foyer for additional information. Our pastoral staff would also love to meet you after the worship service. If you prefer, please call the church office to schedule a time to meet with someone from our leadership team. Our loving congregation is comprised of Christians from the Lake Country area, Milwaukee, Madison, Fort Atkinson, and the Hartford region.